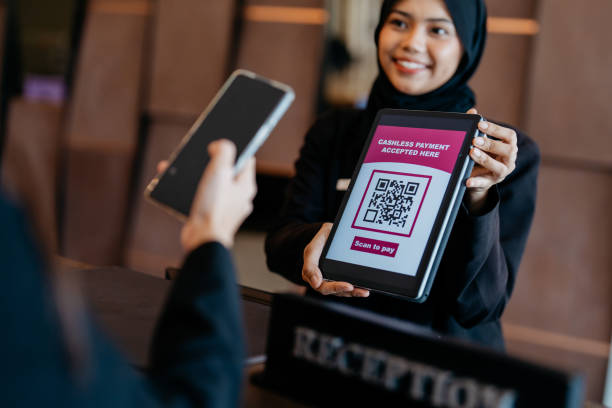

Digital payments have become a way of life for Malaysians. With mobile phones always within reach, it’s easier than ever to make purchases without physical cash or cards. One method that stands out for its speed and convenience is QR code payment. If you’re looking for a secure and seamless way to scan and pay with QR in Malaysia, HLB Connect offers a user-friendly solution that supports daily transactions—whether in-store, online, or even at food stalls.

Why Malaysians are embracing QR payments

The move towards a cashless society has been steadily growing, but recent years have seen a significant surge in QR-based transactions. From small vendors in night markets to national retail chains, merchants are adopting QR codes due to their simplicity and low cost. Shoppers prefer it too, as it eliminates the need for physical contact, speeds up checkout times, and reduces dependency on banknotes or coins.

QR payments in Malaysia are largely driven by the widespread use of DuitNow QR, the national standard that allows users to scan one QR code regardless of which bank or e-wallet they use. This interoperability has simplified digital payments across the board, and platforms like HLB Connect have fully embraced it.

How scan and pay with QR works in Malaysia

QR payments operate using either static or dynamic codes. A static QR code remains fixed and may require the user to manually input the payment amount. A dynamic QR code, on the other hand, generates a unique code for each transaction, including the amount, merchant details, and purpose of payment.

With HLB Connect, users can initiate payment through the bank’s mobile app by scanning the QR code displayed by the merchant. The platform integrates with DuitNow QR, which means users can scan and pay at participating outlets nationwide—even if the business banks with a different provider.

Security is also a major priority. The app includes biometric login, encryption, and real-time transaction alerts to ensure that every scan and payment is safe.

Steps to scan and pay with QR using HLB Connect

Getting started is straightforward. Once you’ve downloaded the HLB Connect App and linked your account:

- Log in to the app using your fingerprint, Face ID, or password.

- Tap on the ‘Scan & Pay’ feature on the homepage.

- Scan the QR code displayed at the merchant counter or online checkout.

- Enter the amount if it’s a static QR code, or confirm the pre-filled amount.

- Complete the transaction by entering your payment PIN or using biometrics.

The process is fast and intuitive, taking just a few seconds from start to finish.

Benefits of using HLB Connect for QR payments

HLB Connect makes everyday spending more convenient. The app links directly to your Hong Leong Bank savings or current account, allowing payments without topping up any e-wallet. It also provides a complete record of your transactions, which can help with budgeting and expense tracking.

Users can enjoy real-time confirmation and push notifications for every transaction. Moreover, because HLB Connect supports DuitNow QR, the app is compatible with thousands of merchants across Malaysia, ranging from petrol stations and restaurants to hospitals and government agencies.

Where you can scan and pay with HLB Connect

From urban centres to rural towns, QR codes have become common in everyday life. Whether you’re buying coffee, paying for groceries, or settling bills, you can scan and pay with QR in Malaysia through HLB Connect at:

- Supermarkets and hypermarkets

- Street food vendors and cafés

- Online businesses with DuitNow QR-enabled checkout

- Clinics, pharmacies, and utility service counters

More merchants join the network each month, expanding the reach of QR payment options and making them a practical solution for all types of purchases.

Conclusion

The future of payments in Malaysia is digital, and QR technology plays a leading role in this shift. By choosing to scan and pay with QR using HLB Connect, users gain access to a secure, fast, and widely accepted method of payment that fits seamlessly into modern lifestyles. With just a few taps, everyday transactions become simpler—no cash, no cards, just your phone.